Web3, NFT, DAO, DeFi, CeFi, ETH, DOT, SOL, AVAX, FTM, blah…

It’s easy to blow off everything blockchain when the hype is so insane. That said, over the last 30 years I’ve been up close to some of the fastest growing businesses the planet has ever seen, and I’ve never seen this speed of innovation or adoption — directly tied to money, no less.

So what does all this mean for logistics? At its core, the world of blockchain is simply a way to build services that have no escrow agent. For example, Walmart is the escrow agent for all of Walmart’s inventory data. Obviously, they have no interest in sharing their inventory data with Amazon. But if Walmart and Amazon could use a 3rd party escrow agent, such as Deloitte, to access their inventory data and find ways for the two companies to lower costs by combining half full containers when they are transported, then both companies might get value out of that escrow agent. Blockchain begs the question: what if the blockchain was the escrow agent, and Deloitte was not needed? In other words, get rid of the escrow agent, but keep all the benefits of a third party verification service.

Where this gets more interesting is where the data flows accelerate, but trust is still an issue. For example, a manufacturer like Apple might want to access all the data from its suppliers’ ERP systems, so it can tighten up its supply chain. Again, a 3rd party could be brought in to mediate. But remember a supplier might have a thousand customers, and all thousand of them might want to access its data. Deloitte could build a massive data marketplace. Or maybe blockchain can offer a better solution.

Now fast forward to the “internet of things,” when every item in a warehouse is broadcasting its whereabouts. Nothing needs to be scanned any longer. Micro-fulfillment houses are everywhere, possibly even inside of your garage. Our biggest enemy is moving inventory needlessly. When the Q4 ramp-up ends, no one wants to be the one holding the leftover inventory. It sure would be nice to hedge against a bad Christmas season. Enter blockchain: our escrowless, financially-savvy network of inventory information, across multiple entities, allows something magical to start happening: manufacturers can lock in prices, just like grain and corn commodities do before tornado season, by buying and selling options against their inventory. A garage owner can store a small amount of non-perishable inventory, and Walmart can pay a premium for one item to be hand delivered two houses down, rather than ship the inventory from a central depot. That same garage owner can buy up options on Walmart’s local inventory, ensuring Walmart a guaranteed revenue through Christmas, while at the same time lowering open stock and driving up prices to sell its own small batch at a higher premium.

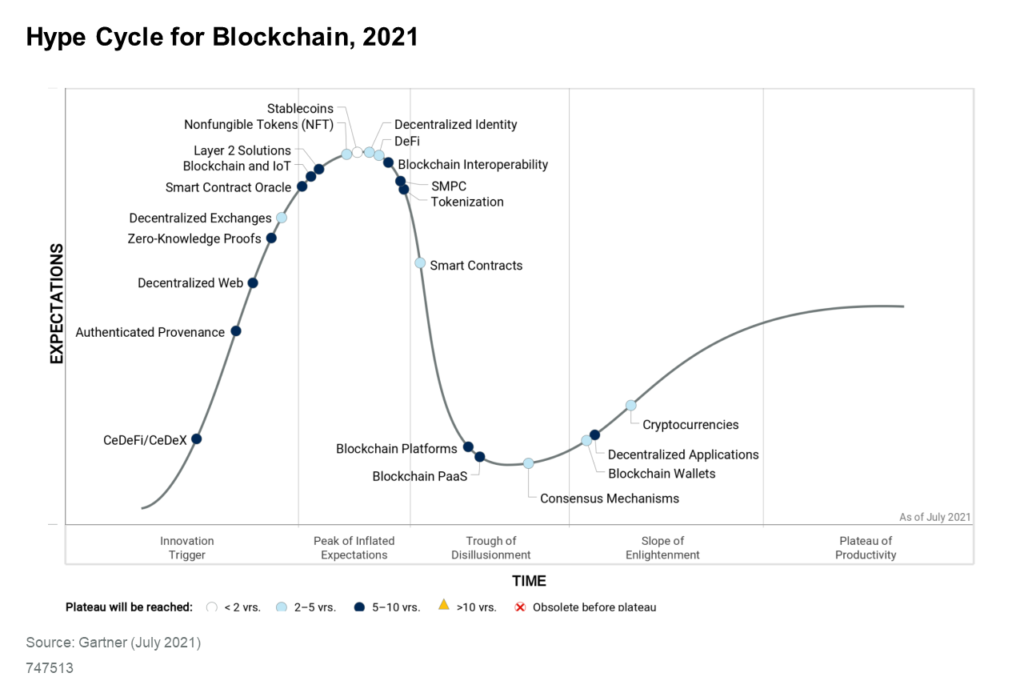

This is all to say, blockchain is following the “build it and they will come” mantra of design, which is usually a terrible approach. But the speed of blockchain innovation is so overwhelming that it is likely to stumble upon interesting new use cases through the formula of brute force x massive repetition = serendipity.

In short: I believe that young crypto addicts that spend evenings and weekends at hackathons can reinvent supply chains. Please visit my office hours and continue this conversation.